Yes you “can” since each new car comes with it’s own credit and there is no max per year or per lifetime limitation however the credit is NOT refundable so if you cannot use them both on one tax return then you lose the excess. Review your situation carefully to see if you may want to delay the purchase until 1/1 and maybe the sale until 12/31.

The easiest way to get a $7,500 tax credit for an electric vehicle? Consider leasing. | AP News

You may qualify for a credit up to $7,500 under Internal Revenue Code Section 30D if you buy a new, qualified plug-in EV or fuel cell electric vehicle (FCV). The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032. The credit is available to individuals and their businesses.

Source Image: youtube.com

Download Image

Feb 8, 2024People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks.

Source Image: nbcnews.com

Download Image

The EV tax credit can save you thousands — if you’re rich enough | Grist Oct 19, 2023Getty. You could call it a tax pre-fund: Starting in January, you’ll be able to get an electric vehicle tax credit of up to $7,500 without having to wait for the IRS to process your return

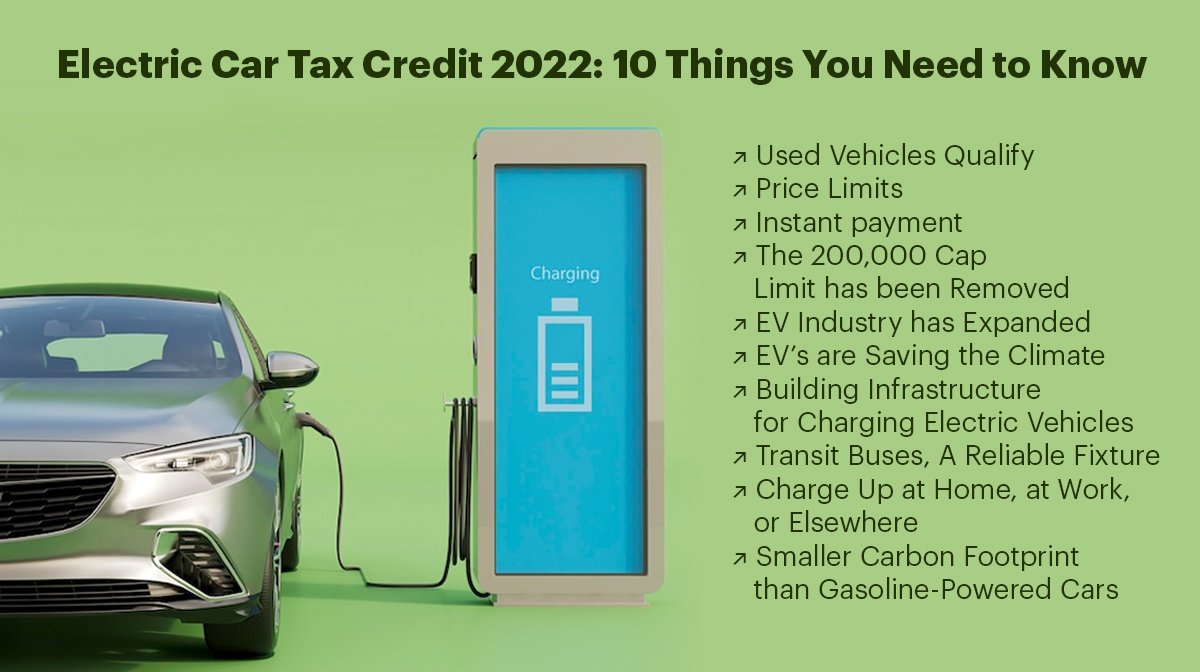

Source Image: e-vehicleinfo.com

Download Image

Can You Get The Ev Tax Credit More Than Once

Oct 19, 2023Getty. You could call it a tax pre-fund: Starting in January, you’ll be able to get an electric vehicle tax credit of up to $7,500 without having to wait for the IRS to process your return Jan 30, 2024The new tax credit for pre-owned clean vehicles lasts for tax years 2023 through 2032. Qualified buyers can get a credit equal to the lesser of $4,000 or 30% of the sales price. Other stipulations apply: Model year must be at least two years earlier than the year you acquired the vehicles.

Electric Car Tax Credit 2022: 10 Things You Need to Know – E-Vehicleinfo

Sign Up Federal Tax credit more than once? | Inside EVS Forum How the $7,500 EV Tax Credit Works: Income Limit, Which Vehicles Qualify | Kiplinger

Source Image: kiplinger.com

Download Image

More EVs Lose Federal Tax Credits Including Tesla, Nissan, GM Vehicles – Times of San Diego Sign Up Federal Tax credit more than once? | Inside EVS Forum

Source Image: timesofsandiego.com

Download Image

The easiest way to get a $7,500 tax credit for an electric vehicle? Consider leasing. | AP News Yes you “can” since each new car comes with it’s own credit and there is no max per year or per lifetime limitation however the credit is NOT refundable so if you cannot use them both on one tax return then you lose the excess. Review your situation carefully to see if you may want to delay the purchase until 1/1 and maybe the sale until 12/31.

Source Image: apnews.com

Download Image

The EV tax credit can save you thousands — if you’re rich enough | Grist Feb 8, 2024People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks.

Source Image: grist.org

Download Image

New US rules, aimed at curbing China, could make it harder for EV buyers to claim a full tax credit | AP News Dec 26, 2023The Inflation Reduction Act of 2022 (IRA) makes several changes to the tax credit provided in § 30D of the Internal Revenue Code (Code) for qualified plug-in electric drive motor vehicles, including adding fuel cell vehicles to the § 30D tax credit. The IRA also added a new credit for previously owned clean vehicles under § 25E of the Code.

Source Image: apnews.com

Download Image

Many electric vehicles to lose big tax credit with new rules | AP News Oct 19, 2023Getty. You could call it a tax pre-fund: Starting in January, you’ll be able to get an electric vehicle tax credit of up to $7,500 without having to wait for the IRS to process your return

Source Image: apnews.com

Download Image

EV Tax Credit: Get an Instant Rebate Now! – Global Village Space | Technology Jan 30, 2024The new tax credit for pre-owned clean vehicles lasts for tax years 2023 through 2032. Qualified buyers can get a credit equal to the lesser of $4,000 or 30% of the sales price. Other stipulations apply: Model year must be at least two years earlier than the year you acquired the vehicles.

Source Image: globalvillagespace.com

Download Image

More EVs Lose Federal Tax Credits Including Tesla, Nissan, GM Vehicles – Times of San Diego

EV Tax Credit: Get an Instant Rebate Now! – Global Village Space | Technology You may qualify for a credit up to $7,500 under Internal Revenue Code Section 30D if you buy a new, qualified plug-in EV or fuel cell electric vehicle (FCV). The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032. The credit is available to individuals and their businesses.

The EV tax credit can save you thousands — if you’re rich enough | Grist Many electric vehicles to lose big tax credit with new rules | AP News Dec 26, 2023The Inflation Reduction Act of 2022 (IRA) makes several changes to the tax credit provided in § 30D of the Internal Revenue Code (Code) for qualified plug-in electric drive motor vehicles, including adding fuel cell vehicles to the § 30D tax credit. The IRA also added a new credit for previously owned clean vehicles under § 25E of the Code.